Press Release

|June 16,2025New Private Home Sales Fell In May Owing To A Dearth Of New Project Launches; Bumper Crop Of Launches Expected In July And August

Share this article:

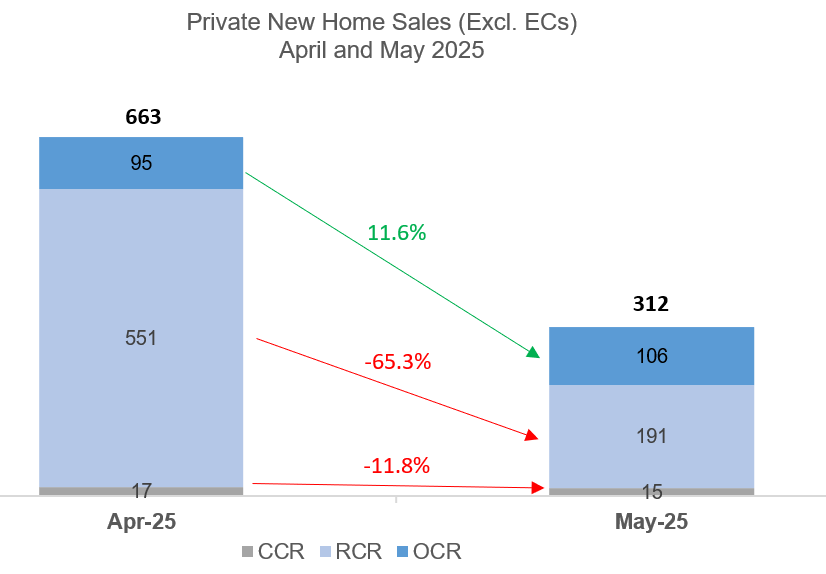

16 June 2025, Singapore - Developers' sales fell to the lowest in five months in May 2025 owing to a lack of new project launches. There were 312 new private homes sold (ex. executive condos) in May, down by nearly 53% month-on-month from the 663 units shifted in April. When compared with May 2024, sales were up by about 40% year-on-year.

This is the first month in 2025 where there have been no fresh projects put on the market. To this end, the decline in new home sales in May is not unexpected, as fresh project launches tend to drive transactions each month. With launch activity still subdued in June, developers' sales are expected to remain relatively muted this month.

In May, developers place 20 new units (ex. EC) for sale - all from previously launched project The Myst. This is sharply down from the 1,344 units launched in April. It is also the joint lowest number of units launched in a month since 2009 - on par with the 20 units rolled out in December 2024.

New home sales in May were led by the Rest of Central Region (RCR) where 191 units were transacted - down by 65% MOM from 551 units in April where the launch of One Marina Gardens and Bloomsbury Residences had boosted sales. The RCR accounted for about 61% of May's total transactions, with three RCR projects topping sales (see Chart 2). One Marina Gardens sold 62 units at a median price of $2,975 psf, Bloomsbury Residences moved 32 units at a median price of $2,506 psf, while The Hill @ One-North shifted 26 at a median price of $2,484 psf. Of note, this is the best monthly sales at The Hill @ One-North since the project sold 39 units in April 2024 - it is likely that the nearby Bloomsbury Residences has helped to generate some buzz and drew in more buyers.

The Outside Central Region (OCR) saw 106 new units (ex. EC) being sold - up from the 95 units transacted in April. This one of the slowest monthly OCR sales this year, following the strong take-up of units at earlier launches, such as Parktown Residence, ELTA, and Lentor Central Residences. The top-selling OCR project in May was Hillock Green which sold 17 units at a median price of $2,285 psf. Meanwhile, Lentor Mansion sold 11 units at a median price of $2,194 psf, and Parktown Residence moved 10 units at a median price of $2,410 psf. It was observed that about 96% of the 2,954 new units at the six projects in Lentor Hills estate have been sold, with 121 unsold units on the market as at end-May.

Developers' sales in the Core Central Region (CCR) continued to be tepid, with 15 new units transacted in May, marginally lower than the 17 units shifted in the previous month. Watten House was the best-performer in this sub-market, transacting four units at a median price of $3,255 psf. Three CCR units fetched more than $15 million each - representing the priciest new homes sold in May. They comprised a 4,489-sq ft unit at 21 Anderson which was sold for $24.0 million, and two units - 4,209 sq ft and 4,219 sq ft - which were sold for $15.1 million each at 32 Gilstead. The three units were purchased by Singapore permanent residents, according to the URA Realis caveat data.

In the EC segment, developers sold 24 new units in May, falling by 75% from the 96 units transacted in April. Novo Place EC and Lumina Grand EC were the most popular EC projects during the month, shifting eight units each at median prices of $1,601 psf and $1,513 psf, respectively. As at end-May, there were just 38 units of unsold new ECs from launched projects on the market, according to the URA data. The tight unsold supply bodes well for the upcoming 600-unit Otto Place EC (in Plantation Close in Tengah), which is anticipated to be launched in July 2025.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"The primary market was quiet in May, with 312 new private homes (ex. EC) sold - the lowest monthly sales this year. This is mainly due to the lack of new project launches in the month, where the 2025 Singapore General Elections also took place. With limited new projects coming on the market in June, coupled with the school holidays where many families typically travel abroad, we expect new home sales to remain relatively muted. In June, there are no major launches lined up, apart from a private placement (limited units released and by invitation only) conducted at Arina East Residences where it transacted nine of its 107 units.

Based on caveats lodged, the median transacted unit price of non-landed private homes in the CCR rose by 3.8% MOM (see Table 1) in May, influenced by a slightly higher proportion of units sold at $3,000 psf and above during the month amid a low transaction volume. Meanwhile, the lack of new launches in May has put a drag on the median unit price in the RCR in May, while that of the OCR was relatively on par with the median transacted $PSF price in the previous month.

Table 1: Median unit price of non-landed new private homes sold (ex. EC) by region, by month, and price gap (%)

Median unit price ($PSF) non-landed new sales (ex. EC) | Price gap (%) | |||||

CCR | RCR | OCR | CCR vs RCR | CCR vs OCR | RCR vs OCR | |

Jan-25 | $2,538 | $2,725 | $2,422 | -6.9% | 4.8% | 12.5% |

Feb-25 | $3,211 | $2,606 | $2,382 | 23.2% | 34.8% | 9.4% |

Mar-25 | $2,989 | $2,643 | $2,218 | 13.1% | 34.8% | 19.2% |

Apr-25 | $3,135 | $2,910 | $2,245 | 7.7% | 39.6% | 29.6% |

May-25 | $3,255 | $2,634 | $2,249 | 23.6% | 44.7% | 17.1% |

MOM % change | 3.8% | -9.5% | 0.2% |

|

|

|

Overall, foreigners (non-PR) accounted for about 2.3% of the non-landed new private home sales (ex. EC) in May 2025, slightly lower than the 2.5% proportion in the previous month. In absolute terms, there were seven deals by foreigners (NPR) in May, comprising five transactions at One Marina Gardens, and one each in Chuan Park and Parktown Residence. Meanwhile, Singapore PRs and Singaporeans made up about 14.5% and 83.3% of the non-landed new private home sales (ex. EC), respectively in May.

Developers' sales are projected to climb in July and August with a clutch of new projects lined up across the mass market to luxury home segments. They potentially include W Residences Singapore - Marina View, Artisan 8 in Sin Ming Road, LyndenWoods in Science Park Drive, UpperHouse at Orchard Boulevard, Otto Place (EC) in Tengah, The Robertson Opus in Unity Street, Promenade Peak in Zion Road, River Green in River Valley, Springleaf Residence in Upper Thomson Road, and Canberra Crescent Residences.

In the first five months of 2025, developers have transacted 4,350 new private homes (ex. EC), more than two times the 1,688 units sold over the same period in 2024. For the full-year 2025, PropNex expects the new home sales volume to come in at around 8,000 to 9,000 units (ex. EC) - higher than the 6,469 units sold in the whole of 2024."

Table 2: Top-Selling Private Residential Projects (ex. EC) in May 2025

| S/n | Project | Region | Units sold in May 2025 | Median price in May 2025 ($PSF) | |

1 | ONE MARINA GARDENS | RCR | 62 | $2,975 | |

2 | BLOOMSBURY RESIDENCES | RCR | 32 | $2,506 | |

3 | THE HILL @ONE-NORTH | RCR | 26 | $2,484 | |

4 | HILLOCK GREEN | OCR | 17 | $2,285 | |

5 | GRAND DUNMAN | RCR | 15 | $2,524 | |

6 | NAVA GROVE | RCR | 13 | $2,545 | |

7 | LENTOR MANSION | OCR | 11 | $2,194 | |

8 | PARKTOWN RESIDENCE | OCR | 10 | $2,410 | |

| THE ORIE | RCR | 10 | $2,631 | |

9 | CHUAN PARK | OCR | 9 | $2,641 | |

| HILLHAVEN | OCR | 9 | $2,098 | |

| PINETREE HILL | RCR | 9 | $2,662 | |

10 | THE LAKEGARDEN RESIDENCES | OCR | 8 | $2,185 | |